Yes it's a new year, but most of the experts are still talking about the same thing, Apple stock. Everyone is waiting for the earning announcement that is expected about Jan. 22. Roughly 80 percent of the experts are predicting a 5 percent to 10 percent increase after the announcement. The rest are predicting bad news that will keep the stock in the low $500s.

A lot of experts keep talking about what a great buy the stock is at around $525. After all, it was over $700 not long ago. But I keep asking myself, if this is such a great price, why are so many people selling it and so few buying it, so the price is not going up?

Even when the stock was $700 a share a few months ago many experts were saying the same thing: it's cheap, it's a good buy, it might go to $1,000 a share. So I too was sucked in and sold five of the $580 puts, taking in a premium of $12,000 figuring that a $700 stock was not likely to go down more than 120 points in two months. But it did — it went down about 200 points, and at that time I had an unrealized loss of $28,000.

But I took some action at that point, and sold what we call an "in-the-money call spread." I bought the $500 calls as protection against a further decline, and sold the $525 calls, paying out about $12,000. But the stock was at $510 at that point, so the position was worth $10,000 if the stock didn't decline further, so my real investment was only $2,000 and the rest was risk — but the same risk as if I owned the stock.

Since then the stock has rallied and is hovering around $525, and at that price my old put position was only down about $14,000 and my new position was up about $12,000, so things have been looking up. And if the stock moves up to $550 or more after the earning announcement I will come out with a profit overall. Whew!

In hindsight, Apple was not a very good stock to write options on because it's too volatile. It's better to write options on stocks that are moderately stable, with a position in the market likely to move up slowly. But even if one viewed Apple stock that way, who can afford to buy stock at $700 a share?

Walgreens remains that kind of stock. I still have some that I paid $47 a share for many years ago. I've been collecting a dividend plus premiums from option writing (covered calls) on the stock for all those years. But the company made some bad decisions and the stock dropped into the low $30s. Now management seems to be cleaning up their act, and the stock is slowly climbing back, now around $38 a share. At that price it pays a dividend of almost 3 percent. And if you write a covered call at $40 or $42.50, you can garner at least another 6 percent a year and end up with 9 percent annualized return on investment.

Enough about the past. What's in store for the new year? Well, most of the experts I follow think there will be slow growth. Those industries affiliated with housing should do well, as the housing market continues to come back. But many of those stocks are already very high because of market anticipation. Whirlpool, for example, has gone up from $55 to over $100, I suppose because they make household appliances. I originally bought it because I thought their access to the Chinese market would bring in profits. But then many experts said that sales to China were slowing down. In the long run I don't think so.

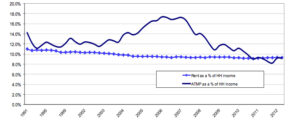

And, thinking about housing, while traditionally it has been cheaper to rent than to buy and own, this year that cost, as a percentage of household income, evened out. So that might put some pressure on real estate rentals, as potential renters leave the rental market and elect to buy a home. Here's what the history looks like:

The housing exchange-traded fund (ETF) has also done well, but not as spectacularly as Whirlpool, so it might still be a good buy. But for myself, I'm putting what little money I have into copper, for example Freeport McMoran—FCX. That's a company that profits from increases in the price of copper, and perhaps to a lesser extent in gold. I'm not a big fan of gold, but I've read that it takes a lot of copper to build a new house or apartment building. And gold can act as a good hedge in the market. So that seems like a good way to get a bit of both.

Some experts recommend emerging markets, except for Brazil and Japan. They seem to be on everyone's bad list. By coincidence those happen to be the two that I own. I bought the Brazil ETF because I thought that they would start to pump oil from the oil fields they found offshore. Still, I feel that eventually the government will get rid of corruption and the country will prosper.

I bought the Japanese ETF partly because my son lives there (not a good reason) and mostly because some economist told me that there was going to be high inflation in the Japanese currency and that would drive the prices of Japanese stocks higher. Time will tell. I never try to understand economists. For myself, I generally stay away from foreign stocks and markets, and prefer to search for companies inside the U.S. that benefit from sales to emerging markets.

So in addition to copper, what do we take away from all this economic speculation? For myself I am looking for stocks with good dividends from companies that are not in financial trouble and will be able to continue to pay the dividends. I prefer those that have options available, so I can increase my yields by writing covered calls on the stocks. But the main reason to seek good paying dividend stocks is that the dividend is a good hedge against a significant decline in the stock price. The only caveat is that the company has to be making the same profit level as when the dividend was set.

A good example might be Altria. It pays a dividend over 5 percent, and seems to be doing well, but one should check that out carefully from time to time. For a more speculative position, for the long term one could consider France Telecom, paying a dividend over 9 percent as the French economy goes into the tank.

All-in-all it looks like this will be a good year to invest in equities, stay away from bonds, and keep some cash in reserve to buy in case of a big dip in the market.

For information about Merv Hecht and more details on the strategies and stocks he writes about in this column, visit his website at DoubleYourYield.com.