In Tuesday’s relatively run-of-the-mill City Council meeting, Councilmembers voted to approve the proposed business license modernization and associated business license tax rate changes.

Stephanie Manglaras, Assistant City Treasurer was joined in chambers by Finance Department Director Oscar Santiago, Haley Favre-Smith, Business License Administrator and Eric Myers, Director of Operations of HdL and Andy Belknap, Managing Director with Baker Tilly.

"The revenue collected from the business license program is integral to the health of the general fund and an important resource to advance the city council's strategic priorities and maintain essential services," said Manglaras.

According to Manglara, the finance department collects business license taxes from approximately 23,000 businesses and 13,000 of those are physically located within the city and the City of Santa Monica adopted its existing business license tax code in 1990, more than 30 years ago.

"As you see … there has been a substantial shift away from the bricks and mortar businesses from the 1990s … The pandemic has also had a lasting impact on operations, and how some of our largest taxpayers will operate in the future. Modernizing the tax code will reflect the economic changes that have occurred in the world and will continue to occur," Manglaras said.

The changes seem to be met with little resistance from Council and indeed, this same presentation was given to the board of directors at Downtown Santa Monica, Inc. just a week or so ago and following a considerable amount of discussion and further clarification was approved 9-3, with board members Lora Vrastil, Luke Cain and Julia Ladd abstaining.

Vice Mayor Lana Negrete — herself the owner of a small business, which consequently puts her in a position to offer a valuable perspective — raised a very pertinent point, suggesting that perhaps it might be advisable to redefine "small business" and additionally include a new category, "micro business" in order to better differentiate business endeavors at the Small End of the spectrum.

"I know we call mid-size businesses five million and under, but if you're applying for loans, and you're a small business, you know that that's actually a small business and we should maybe use phrases like ‘micro businesses’ for 100,000 and under because the reality is [you might be] making cookies or bracelets and selling them at the farmers market," Negrete said.

She added that it was important to continue to focus equally on these small-scale businesses and additional clarification of each one’s size and composition would certainly help the owners secure bank loans and potential investment.

There was also some inquiry about the "corporate administrative headquarters" classification and how existing incentives to bring employees back to the office after the pandemic might affect this, or even be affected by this. However, the answers provided were almost all theoretical.

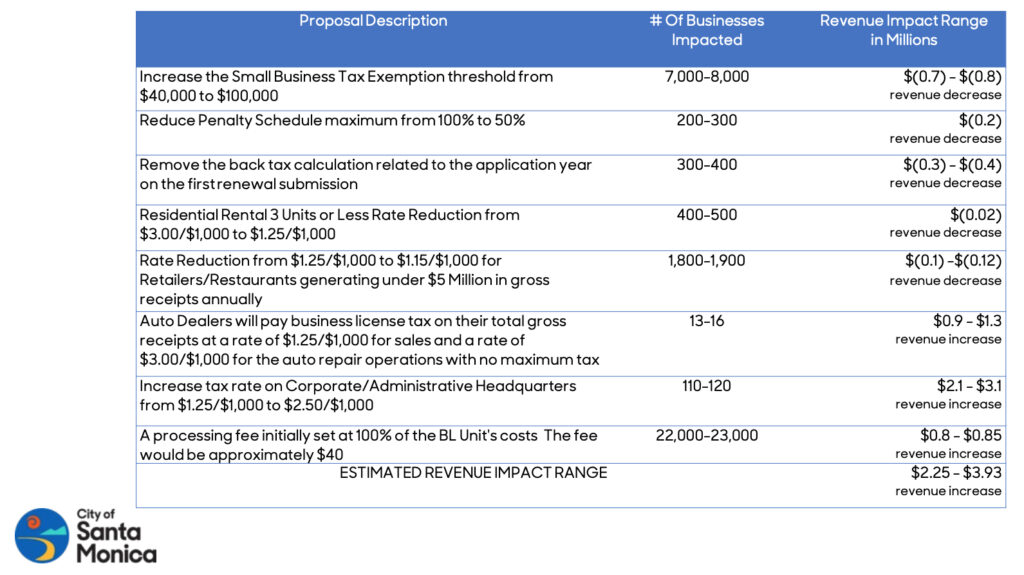

"The way that this tax proposal is being structured is really a prioritization around equity and leaning forward into supporting our small, medium-sized businesses," City Manager David White responded, adding, "So whatever direction we get from this meeting, looking to stagger or make adjustments for the corporate headquarters, we'd have to take a step back and see what we could afford in terms of offering those incentives and brakes … Because as you saw, the forecast is that we could generate two to four million [dollars] in revenue, but there's a lot of movement in those numbers. So we can't guarantee that it's going to generate that much. That's our current forecast of what we think."

Because the auto industry is such a big generator of income in the City of Santa Monica, Councilmember Oscar de la Torre asked about the history of that particular cap.

Manglara explained that she had pulled all the records that she could find from the 80s and found that the cap started at about $2,500. It was increased in 1983 and again in 1990 and there was discussion to remove it. But the same conversation occurred and the cap went from $5,000 to $20,000 in 1990 and then it scaled up in 1992 to $25,000 where it has remained.

A motion was eventually made by Councilmember Caroline Torosis, "With the proposed changes related to the phased-in approach, any additional incentives — if possible — and clarification on definitions of small businesses, while maintaining the very equitable approach that you have all taken, which we appreciate, prepare a draft measure for modernization to be placed on the November 2024 ballot."

The motion was seconded by Negrete and passed unanimously 7-0.