The economists that I follow are predicting a wonderful 2014. Real GDP growth should be at least 3.4 percent. The unemployment rate should fall to under 6.5 percent. Inflation will remain low, with interest rates moving up only slightly.

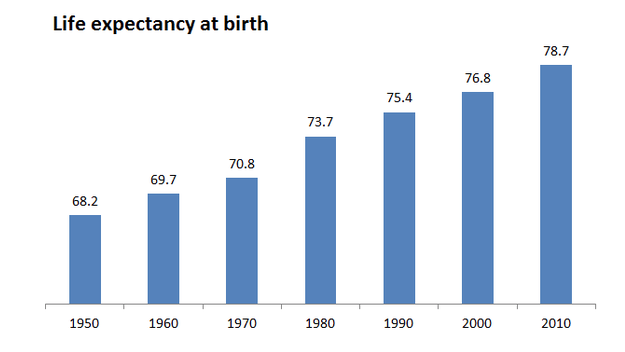

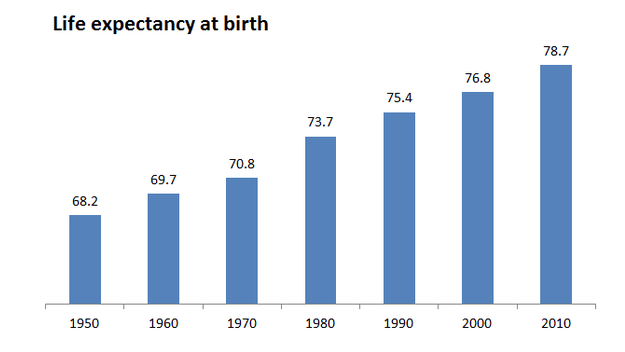

But if you read the newspapers you would believe that people are underpaid, uninsured, and over-medicated. Yet everyone understands that things are better now than ever. We have cell phones, better cars and computers, crime is down, life is safer, and we're living longer and better. Medical technology is fantastic. And years ago who would have believed that something like Viagra would be available? Even sex is better than in the good old days.

But if you read the newspapers you would believe that people are underpaid, uninsured, and over-medicated. Yet everyone understands that things are better now than ever. We have cell phones, better cars and computers, crime is down, life is safer, and we're living longer and better. Medical technology is fantastic. And years ago who would have believed that something like Viagra would be available? Even sex is better than in the good old days.

Not only are we healthier, we're richer as well. Confidence was very high in 1995, before the economic downturn, but we're better off financially now than we were then.

One hundred years ago, a man in the U.S. could expect to die by age 51. Now the average age for that man to retire is 61. Poverty is down, more American adults are in the labor market, and our work week has declined to under 40 hours per week. Holiday and vacation time is up and more people graduate from high school than ever before.

One hundred years ago, a man in the U.S. could expect to die by age 51. Now the average age for that man to retire is 61. Poverty is down, more American adults are in the labor market, and our work week has declined to under 40 hours per week. Holiday and vacation time is up and more people graduate from high school than ever before.

In "The Rational Optimist," author Matt Ridley writes: "Today, of Americans officially designated as ‘poor,' 99 percent have electricity, running water, flush toilets and a refrigerator; 95 percent have a television; 88 percent a telephone; 71 percent a car; and 70 percent air conditioning. Cornelius Vanderbilt had none of these."

So perhaps 2014 is time to become optimistic and invest in those wonderful areas of life that are continuing to improve. Want to feel better? Take vitamins, as so many people do. And invest in some of the companies that create or market them, like GNC. And just hope that Amazon doesn't go heavily into the same business.

Or buy some UnitedHealth Group (UNH) to take advantage of the burgeoning healthcare market.

Believe that the experts are right and the economy will continue to improve. Bank of America (BAC) seems like a good bet to benefit from that, if they can ever pay off their litigation liabilities. I'm selling the 15 puts naked to pick up some premium and acquire the stock at 15 if it dips. And I'm holding JPMorgan Chase (JPM) since it seems to be doing well.

Impressed with the technology advances? Consider General Electric (GE) and Intel (INTC). These are solid companies which one could expect to grow along with the economy.

For information about Merv Hecht and more details on the strategies and stocks he writes about in this column, visit his website at DoubleYourYield.com.