It's the end of a quarter, and, as is my habit, I look back and try to figure out what I did right and what I did wrong. A bit like what Santa asks the kids on his lap at Christmas time.

It's the end of a quarter, and, as is my habit, I look back and try to figure out what I did right and what I did wrong. A bit like what Santa asks the kids on his lap at Christmas time.

With that information I try to figure out what to do next.

I made some good calls on stocks and ETFs. Bank of America went from 5 to 12, and I made a few bucks on that. Now it seems stuck at 12 and I was thinking of writing call spreads against it but the premium is too small to warrant the costs. Whirlpool went from 55 to 116 and is now pulling back a bit, but with the housing market so strong I'm afraid to write call spreads on that. Anyway, who wants to write options on a stock that is volatile? My housing ETF did really well, and I'm holding it.

But with the market as hot as it's been, most people did well, so I can't pat myself on the back for picking a few good stocks. The true test of a person in the investment market is how little they lose when the market goes down, not how much they make when the market goes up. And usually down is much faster than up.

So where did I go wrong? All my readers know about Apple, which I didn't think could drop from 700 to 500 so quickly, and then down to about 425 where it is today. On paper I've lost a little bundle there, but as my favorite language mentor used to say, "it's not over until it's over."

And it's not over. My liquidity has been badly hurt, but I am recouping some of the paper loss (I'm still holding the underwater positions) week-by-week, month-by-month. And if Apple ever moves up 15 percent I'll be back into a profit position. There is an announcement coming on April 23 — keep your fingers crossed. Meanwhile I'm taking in around $5,000 a month on call spreads which are very safe since if the stock goes up I might lose a little bit on the call spreads but make more back from the put positions on which I'm underwater. So month-by-month, I'm coming back!

But Apple hasn't been my only failure. I took a position in copper (FCX) and gold manufacturing (GDX). Both have failed to perform. Copper is really down, and I think it's a good time to buy into it. Better than when I bought into it. And I thought that gold processing companies would be a safer investment than gold itself, but so far it hasn't turned out that way. I'm holding my copper position a while longer, but in general I don't think commodities are the place to invest right now.

So what am I going to do in the second quarter? There are two stocks that look good to me, and I hope I have enough liquidity to get into them: one is Google. Yes it has already gone up a lot, but it is now one of the leading tech companies in the world. My mother used to say "buy companies that you see yourself using." I use Google every day. It could easily be a stock that goes over $900 a share.

The other stock that looks really good to me is Facebook. At $27 a share I think it could easily go up to $35 or more. It seems to be a really well run company with innovative ideas that are catching on more and more.

In general I'm optimistic for the U.S. equities market, and pessimistic on the U.S. bond market. Everything seems to be getting better and better, including housing, jobs, earnings and dividends. But because of remaining weaknesses I don't think interest rates will go up for a while, and bond returns will not compete with returns on equities or option premiums. While there will no doubt be a substantial dip or two, in the long run I think we will end up the year with the indexes higher than they are now.

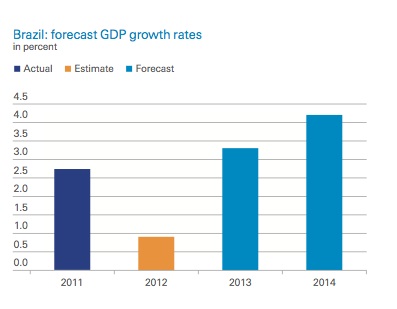

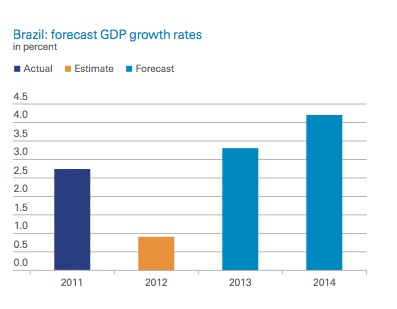

I'm out of Europe, but still holding my ETF on Japan, the economy of which seems to be moving up. And I'm holding on to Brazil, although it hasn't begun to move up yet. [See chart]

And if you see any way to invest in the air pollution solution industry in China, grab it, because China will have to do something big soon to fix its pollution problems.

In a good economy it's a good idea to try to capture unusually high dividends. So companies like Procter & Gamble, Johnson & Johnson, Microsoft, Sysco, and lesser-known companies like EPD, ECA, ETP and DPM can be a good pick for those with risk tolerance. Which of course describes everyone but no one admits to it.

And don't pay attention to those that say that the government "sponsored" low interest policy is killing the average Joe because he can't get enough interest on his life savings to pay his bills. By and large it's only the rich that have a lot of investments in bonds and bank accounts. Most people rely on wages to live on, not interest income. And most people have more debt than savings, so low interest rates help them.

For information about Merv Hecht and more details on the strategies and stocks he writes about in this column, visit his website at DoubleYourYield.com.