I like to write options, but not every worthwhile stock has sufficient trading in options to be a good candidate for that strategy. Two such stocks are Enbridge, Inc. (ENB) and Spectra Energy Corp. (SE). Both of these are in the natural gas pipeline area, currently something many professionals are recommending.

Enbridge, primarily a Canadian pipeline company, certainly has a good dividend; currently about 2.9 percent and that should act as some kind of a cushion against a major decline in value. The problem I see with it is that it has a PE ratio of 51, which means the stock price is very high compared to earnings. That's typical of stocks which the market people think are going to go up dramatically. But it means that you are, in effect, paying a price justified in the future, not now. Still, with that dividend, it seems like a good long-term holding.

Spectra has an even higher dividend, about 3.9 percent, which seems even more suspect. But it has a PE ratio of only 17, not much above the market average. This Texas company owns and operates natural gas facilities and pipelines in the northeast and southeast of the U.S. and parts of northeast Canada.

So maybe one should buy a little bit of both?

Down on Dow

I noticed on both the radio and television lately that the Dow Jones index gets the biggest play. Sometimes the S&P 500 index is not even mentioned. That's a mistake, and I think you will see this change over the next year or so.

The Dow Jones is not a very representative index. A very small number of companies make up the database, they are not typical of today's market and it is price weighted without consideration of trading volume.

The S&P corrects all of these deficits and is much more representative of the overall market. The only problem with this index is that it is skewed toward very large companies. That's no problem for me because I prefer to invest only in large companies. But for those who think otherwise, there is always the NYSE Composite index, which averages all the stocks traded on the NYSE, which is about 60 percent of all traded stocks. Alternatively one can look at the NASDAQ Composite index, a market-weighted index of 3,000 stocks traded over the counter. These tend to be smaller technology companies. For young people looking for long term, very high growth, those might be the companies to invest in.

The broadest barometer of all the indices is the Wilshire 3000 Equity Index, but since few investors use it, the S&P seems favored. Personally I watch the S&P because one of the best ways to invest in options is to use the "SPY," an option tied to the S&P 500. For both buying and selling options using that index — a basket of 500 stocks — gives a lot of diversity, and protects against the kind of major swings that occur when unexpected events happen, such as the indictment of a CEO for fraud. Even if one company in the S&P 500 has a big swing, the overall index doesn't change much.

Merv's moves

Finally we come to that part of the column which I'm sure is the least interesting: what am I doing this week in the market?

What I notice is that both Apple Inc. and Google Inc. are taking over the Internet and hi-tech areas. They look really solid and not likely to go down more than 10 percent over the next 30 days. Nor do I think they will go up that much in 30 days.

So I am writing put spreads on both stocks, with approximately 10 to 15 point spreads between the short position and the long hedge. For example, I am selling 10 puts of the Apple 615s for SEP, and buying the 600s, for a net credit of about $2,400. At the same time, as an additional hedge, I am selling the 700 calls and buying the 715s to hedge that, for an additional credit spread of $1,400.

I take in $3,800, with a theoretical risk of $15,000 for a 30-day period, less the $3,800 or $11,200 maximum risk. But that risk can also be reduced by subsequent trades if the stock moves close to the strike prices.

If the stock stays between 615 and 700, I get to keep the $3,800. It is at 648 today.

I am doing substantially the same thing with Google. I sell the 625 puts and buy the 605s to hedge, and sell the 700 calls and buy the 710s to hedge. I take in about $6,000 on this trade. There is not much risk if Google moves up, but there is more risk if it moves down.

Time will tell. Stay tuned.

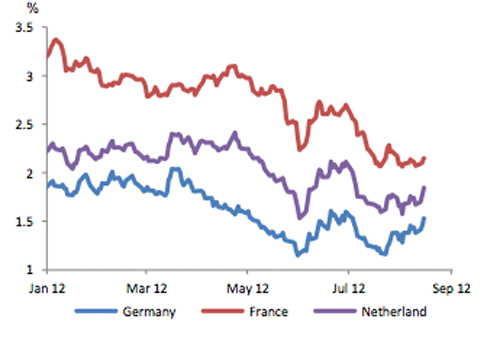

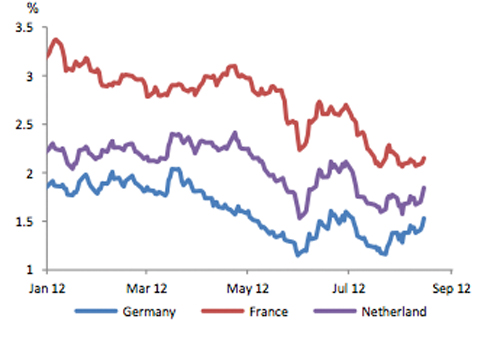

Finally, I pat myself on the back. At the beginning of the year I told a bank trust department, to whom I was acting as consultant, to sell European equities. We had a lengthy exchange, since their advisors felt those equities should be included for diversification. Here is what has happened to the leading Euro equities since then:

Aren't we glad we're not invested in that group!

For information about Merv Hecht and more details on the strategies and stocks he writes about in this column, visit his website at DoubleYourYield.com.