Members of council gave us a mixed bag of results for the proposed ballot measure items in the last City Council meeting. First up was the business license tax discussion. Stephanie Manglaras, Assistant City Treasurer gave a presentation along with Finance Department Director Oscar Santiago.

“Santa Monica’s business license tax has not been revised since 1990. Passing this measure would update the tax and make it more equitable. For example, it would exempt small businesses and cut rates for medium-sized businesses including restaurants and many retail stores,” said Manglaras.

“It would also close loopholes that have allowed some large corporations to avoid paying an appropriate share of the tax. In addition, it would modernize the tax code to account for businesses that did not exist in 1990, such as online businesses,” she added.

Ultimately, every member of council was in agreement and Vice Mayor Lana Negrete offered her unique perspective as a small business owner stressing that the City needed to continue to help small businesses.

Because the city of Santa Monica is the proponent of this measure, a member of Council has to be on the ballot, designated to make the argument for this case and as Councilmember Gleam Davis pointed out, it cannot be anyone who is running for reelection.

“The people who would be eligible to sign the ballot arguments would be people who are not running for reelection, since I gather, some people haven’t made their mind up,” Davis said.

All members of Council agreed that Negrete should take on this particular responsibility and a motion was made by Councilmember Caroline Torosis and seconded by Negrete. That motion, in essence is a resolution submitting to voters a measure to amend the municipal code to modernize the City’s business license tax. This will increase the exemptions for small businesses, raise the corporate administrative headquarters rate to 0.25%, remove auto dealer tax exemptions and restore a processing fee.

In addition, it will authorize City Councilmembers to file written arguments for or against the measure and direct the City Attorney to prepare an impartial analysis of the measure. With the minor amendment that this was phased in over three years, beginning in January 2025, the motion was passed unanimously 7-0.

The second part in this meeting’s ballot-based trilogy was in connection with the City’s parking facility tax rate and a proposed hike of an additional 8% to privately owned lots and structures. In 1993, a 10% parking facility tax was placed on all parking sold in Santa Monica, to address concerns related to a general fund budget shortfall forecasted for fiscal year 93-94.

Manglaras explained that this tax is currently assessed in all city owned and private parking lots and structures and calculated based on the total parking fee charged by the operator for use of the parking facility with some negligible exclusions.

Many neighboring cities do not have a parking tax including Culver City, West Hollywood and Beverly Hills, consequently, the increase to an 18% parking tax would result in Santa Monica having the highest parking tax in the region.

Councilmember Oscar de la Torre pointed out that perhaps adding another tax hike to the ballot might not be a popular idea. Councilmember Christine Parra made another astute observation, which was while public parking might not be affected, hospital parking would be.

“My mom goes [to UCLA hospital] every week [for chemotherapy] and I was there with her for an hour and a half. And I had to pay $18. And so an 8% increase on that. That’s a lot of money,” Parra said, adding, “And this should be the last thing they’re thinking about, having to pay [more in] parking multiple times a week when they have to go get their therapy.”

Negrete supported this by speaking about how, given the proximity of her business to both UCLA Medical Center and Providence Saint John’s Health Center, parking spaces around her shop are seldom available, which means her staff struggle.

“We have four parking spots and our landlord has decided to rent out half of those. So our employees have nowhere to park,” she said, adding, “You have a limited number of meters, and the rest is permit parking. And we’re not allowed as businesses to get passes, you have to be a resident. So we deal with this all the time, we have 47 music instructors that teach lessons at our store, they have nowhere to park.”

Concern was also expressed over whether the extra income generated would just “keep filling the black hole of the general fund and never really going anywhere,” as Negrete eloquently put it.

Davis made some interesting observations on both sides of the argument, however, her intent to support the proposal didn't waiver.

“I’m not pissed off about the parking tax, I’m pissed off at a cost of $23 to park off the top anyway, I don’t think the additional buck 40 is what’s going to make the difference,” Davis said.

Councilmember Jesse Zwick also expressed his intention to support this, making reference to the additional funds it will generate. “We’ve been having discussions for the whole month now about how we can afford to pave our streets, fix our sidewalks and augment the public safety in our city, including hiring more officers. And I see $7 million a year as being very helpful in these discussions to help obviate both priorities.”

The motion was moved by Zwick and seconded by Davis. The voting fell along council political lines, 4-3, with de la Torre, Negrete, Parra and Mayor Phil Brock voting no, while Councilmember Caroline Torosis joined Zwick and Davis in voting yes. Consequently, it failed and will not be on the ballot in November.

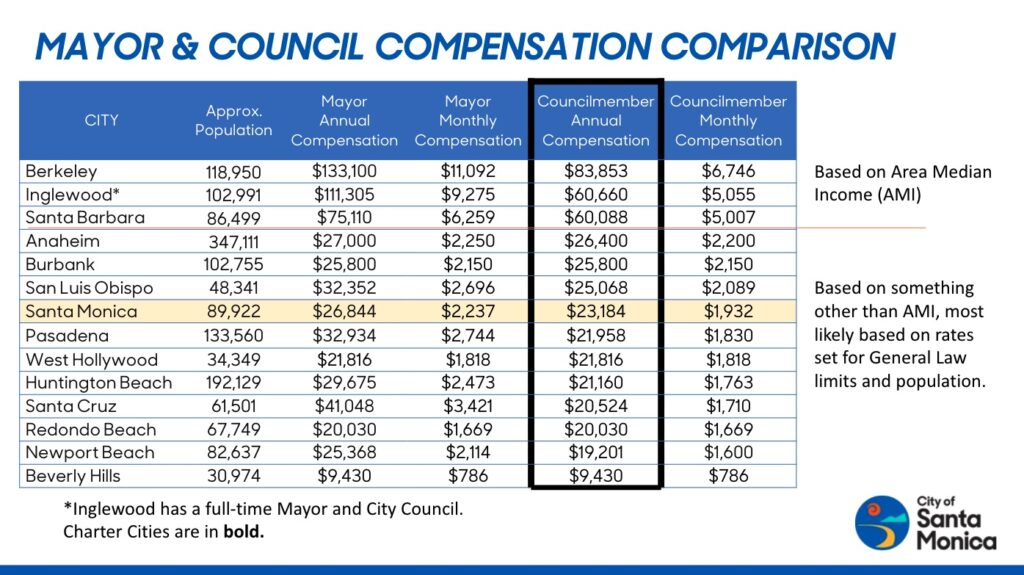

The final item in this bundle was arguably the most contentious, should councilmembers be paid more? Brock said the public would not support any pay increase.

“There’s no way I would take anything to the voters right now, for myself, when my city is suffering, and that’s the bottom line,” he said. “Within our budget of $700 million, should City Council be paid more, absolutely yes … It’s hard to tell your City Manager what you want him to do when he’s being paid 40 times what you’re getting paid a month, or a year. Regardless, we don’t need to labor this.

“There’s no way in hell I would vote for salary increase for any of us right now. We’ve got too much work to do in the city,” Brock said.

As such Council dismissed the item and moved on. However, while these three potential ballot measure items had the benefit of scrutiny and analysis, Brock had intended to request that the City Attorney and City Manager return to City Council with a proposal to place a parcel tax measure on the November 2024 ballot to generate resources to address public safety and homelessness. But given how late — or rather how early into Wednesday morning — the meeting had already gone, this was pulled.