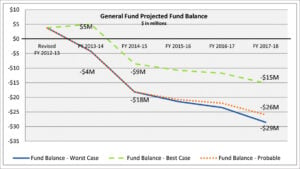

CITY HALL — Santa Monica could face a $29 million budget deficit by 2018 if the City Council does not act decisively to rein in spending and increase revenues, finance officials say.

The bleak prognostication is the worst of three scenarios put to the City Council when it tackles the five-year budget forecast at its meeting on Tuesday, but the two other options — probably and best-case scenarios — still show a $26 million and $15 million gap respectively.

That comes out to a projected deficit ranging between 4.4 to 8.5 percent of the general fund by 2018, "a deficit level that can be managed and therefore eliminated using careful planning and budgeting," according to the city staff report.

To get the potential train wreck under control, city leadership will have to find a combination of cuts and revenue increases to the tune of 5 percent of the city budget and, for the long term, return to the negotiating table with the two largest unions in the spring, said Gigi Decavalles-Hughes, finance director with City Hall.

That could include limiting raises, targeted spending cuts and new or raised fees.

If that happens, the problem is entirely erased, and puts the city's long-term fiscal position up between $1 million and $15 million.

"In Santa Monica, we use the five-year forecast so we can really look at the worst case scenario and handle the worst case," Decavalles-Hughes said. "If we didn't do that, we would be reactive, and possibly have bigger issues or problems if we waited until things happened to us."

At the offing, it seems that most of the report is fairly positive on Santa Monica's finances.

The national economy is improving, and even the state of California has its operational deficit more or less under control, according to the Legislative Analyst's Office.

In 2011-12, Santa Monica had one of its best years in terms of taxes raised on hotel stays and sales taxes, which got a 44 percent bump over the previous year as a result of the 2010 half-cent sales tax increase and the opening of Santa Monica Place, according to the report.

A feeling of loss

However, the loss of the Santa Monica Redevelopment Agency in February of last year, combined with inflation and an increase in labor costs, all weigh heavily on the city budget.

"The big story is really redevelopment," Decavalles-Hughes said.

Redevelopment was a tool used in California to use property tax money to pay for rehabilitation of dilapidated or blighted areas in cities. Santa Monica's was created after the 1994 Northridge earthquake, and was used to pay for things like the $47 million Palisades Garden Walk Park on the one hand and affordable housing production on the other.

It was also a major way that Santa Monica funded capital improvements, basically the upkeep on its infrastructure.

Actions by Gov. Jerry Brown, the legislature and the courts ended redevelopment in California, and the Department of Finance has been charged with recouping money held by the now-defunct agencies.

That comes out to $54.5 million in Santa Monica alone. City officials paid out $12.5 million of that last year, but are fighting with the Department of Finance over the remaining $43 million, according to the report.

Just paying for existing bills for programs and employees will put another $1.3 million a year of pressure on the general fund, but it doesn't stop there.

City Hall has sunk an average of $21 million into infrastructure and other capital projects each year, a number that hasn't changed although the source of those funds is gone.

According to the staff report, City Hall will need to find an additional $9 million a year beginning in 2014-15 to pay for those improvements, which include projects like the Lincoln Boulevard Streetscape and part of the Corporation Yards rehab.

"It is important to note that this additional funding will not fully-fund the capital improvement needs of the city," the report states.

Still, the report does not suggest cutting back on capital improvements, instead relying on cutting other costs and raising revenues.

Deferral of capital improvements or increased reliance on any one strategy would probably impact the high level of services that Santa Monicans have come to expect and in part accounts for the city's success in dodging the worst of the recession.

It's the little things that make Santa Monica feel like a world-class city, a product that Misti Kerns, president and CEO of the Convention & Visitors Bureau, sells to the outside world.

The lack of graffiti, access to public transportation, upkeep of public space and even oversight of beach activities make Santa Monica a welcoming and orderly place, Kerns said.

"We need to keep our services and city team supported to continue to offer such an incredible quality of life for our residents, businesses and visitors," Kerns said.

Rising pension and health care costs have also put a damper on Santa Monica's economic future.

Last year saw pension costs hop up by 16 percent to $38 million. At the same time, the California Public Employees Pension System, or CalPERS, announced that its investment growth would decrease by .25 percent, leading to further increases for cities.

Under best and probable-case scenarios, health care costs are expected to go up by 14 percent in 2014-15, and then 12 percent in the following year.

City Hall recently won concessions from the unions that represent its employees, causing them to, for the first time, contribute to their retirement plans and instituted a second-tier retirement program that gives fewer benefits to those hired after July 1, 2012.

It will take decades to see the results of those deals, however, and more may need to be done this spring, according to the report.

ashley@www.smdp.com